Printable Nc Form D-410 - Web form to your return. Web the way to fill out the nc dept of revenue forms d410 online: To start the document, utilize the fill camp; Electronic filing options and requirements; You are not required to send a payment of the tax you estimate as due. This form is not required if you were granted an automatic extension to. Third party file and pay option: Using efile allows you to file federal and state forms at the same time or separately. The advanced tools of the editor will lead you through the editable pdf template. Pay a bill or notice (notice required).

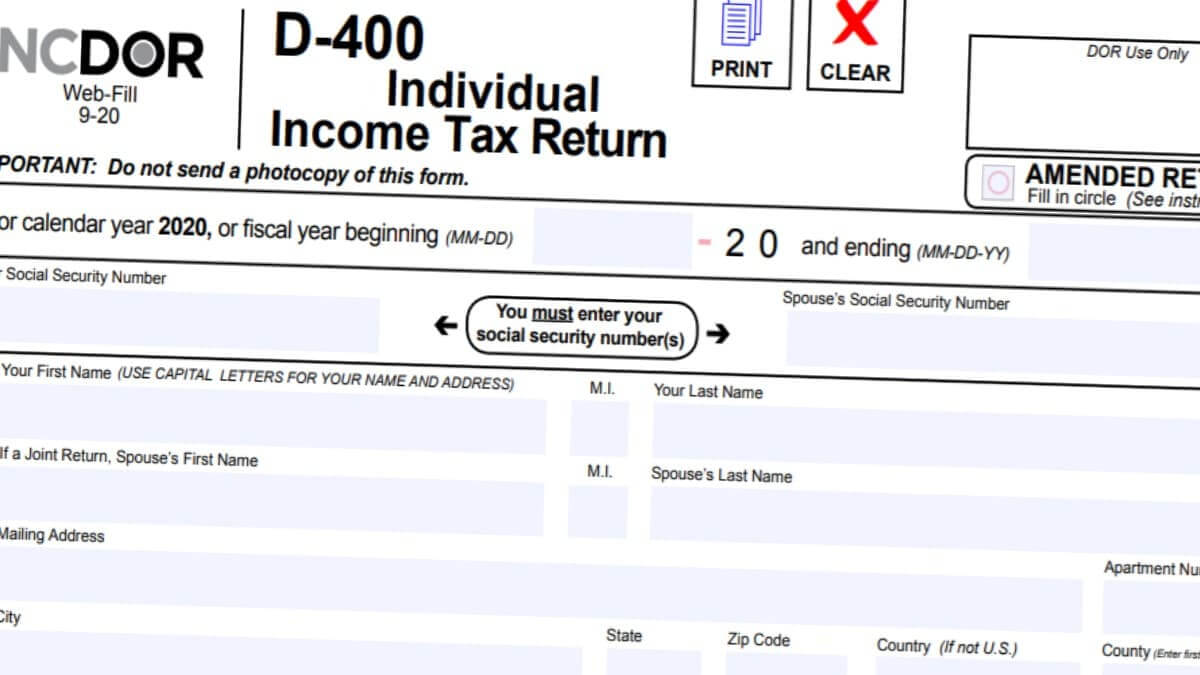

D400 Form 2022 2023 IRS Forms Zrivo

The advanced tools of the editor will lead you through the editable pdf template. D410 nc tax extension get d410 nc tax extension how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save d410 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

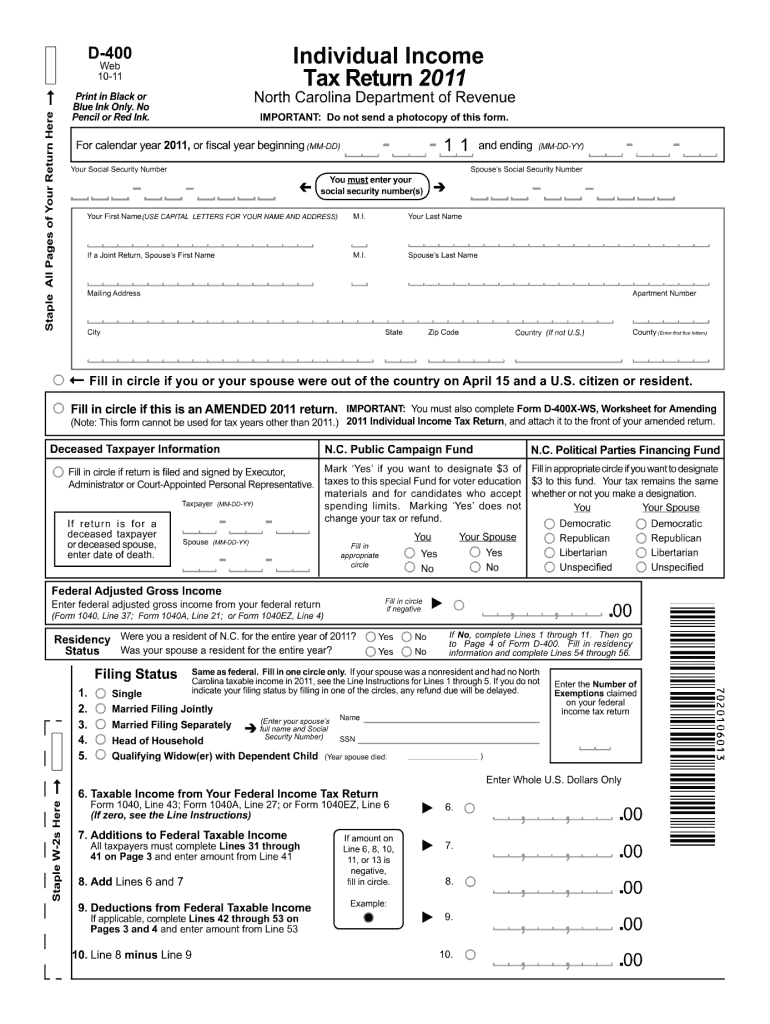

2011 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Third party file and pay option: However, because an extension of time to ile the return does not extend the time for paying the tax,. Using efile allows you to file federal and state forms at the same time or separately. To start the document, utilize the fill camp; Complete this web form for assistance.

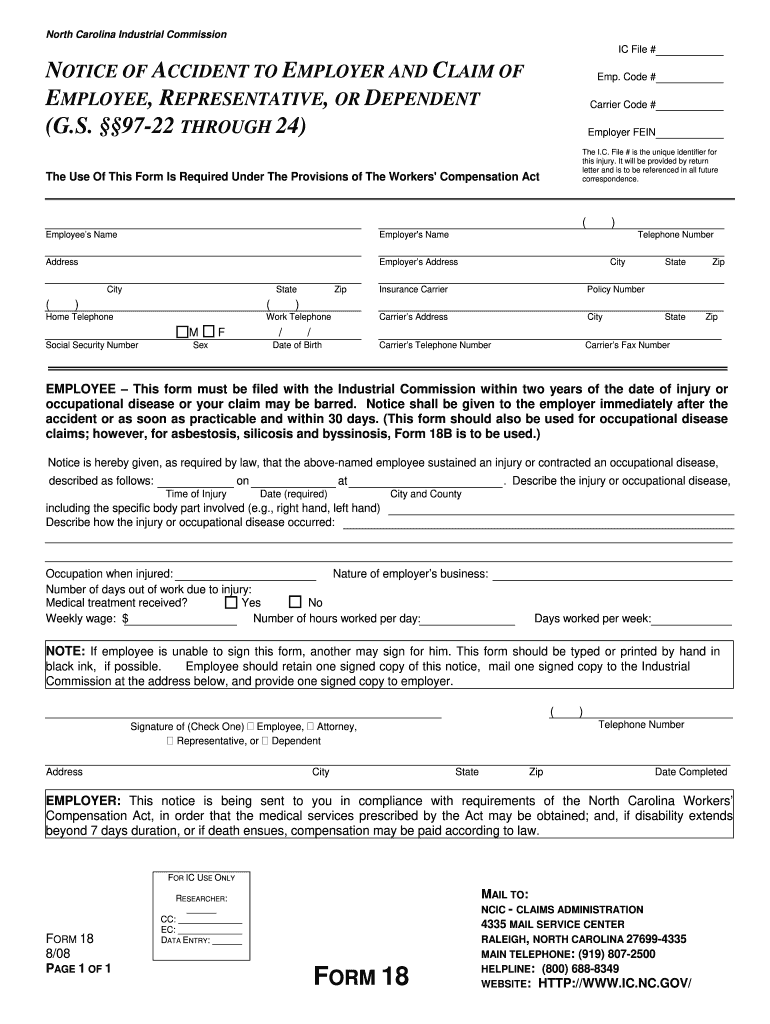

Nc Form 18 Fill Online, Printable, Fillable, Blank pdfFiller

If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. Electronic filing options and requirements; Using efile allows you to file federal and state forms at.

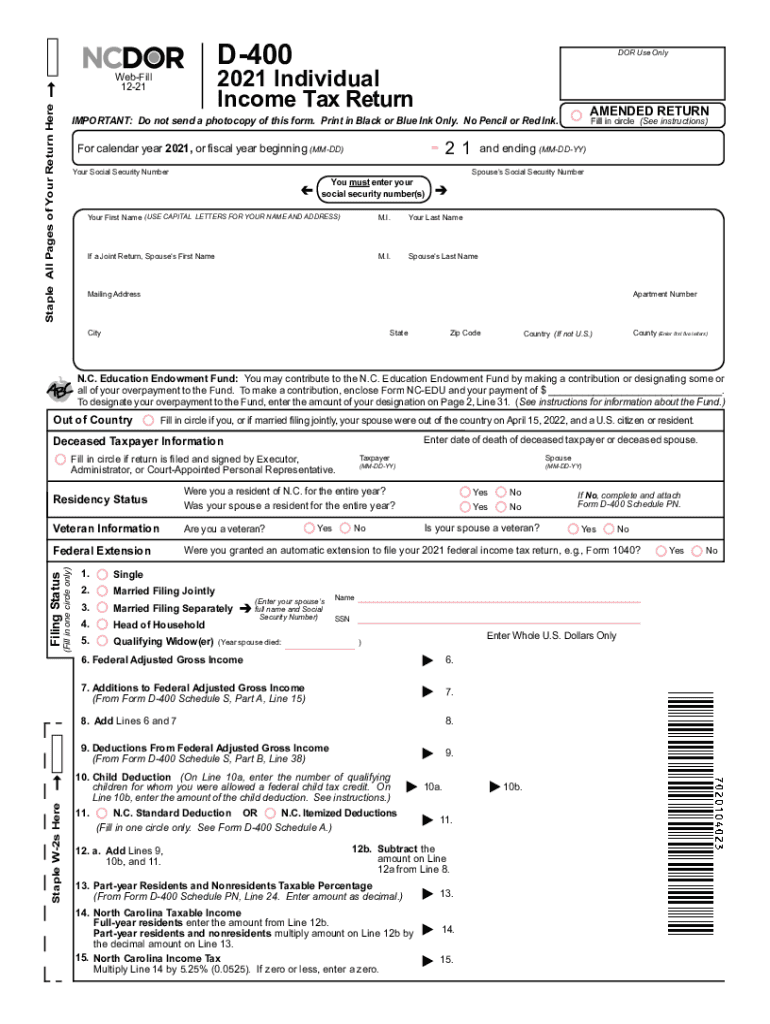

2021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Web without a valid state extension, a n.c. To receive the extra time you must: The days of distressing complicated tax and legal forms are over. You are not required to send a payment of the tax you estimate as due. D410 nc tax extension get d410 nc tax extension how it works open form follow the instructions easily sign.

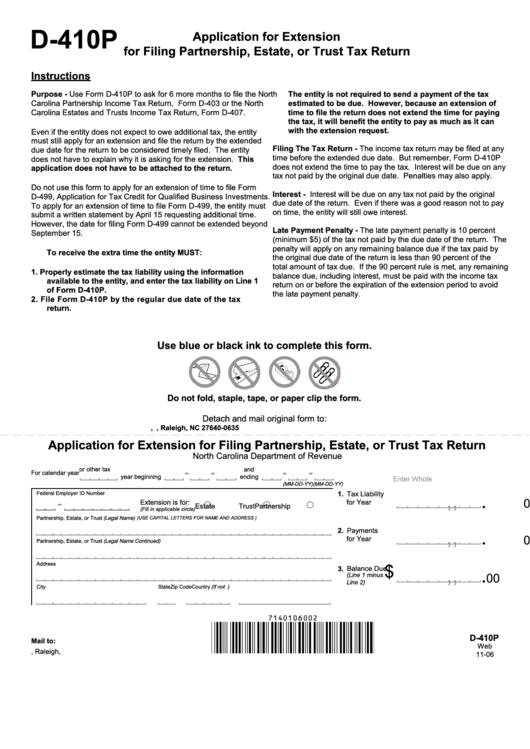

Form D410p Application For Extension For Filing Partnership, Estate

Apply a check mark to indicate the choice. You are not required to send a payment of the tax you estimate as due. To start the document, utilize the fill camp; North carolina department of revenue. Sales and use electronic data interchange (edi) step by step instructions for efile;

NC DoR D400 2015 Fill out Tax Template Online US Legal Forms

To receive the extra time you must: A powerhouse editor is already close at hand giving you a wide range of advantageous tools for filling out a printable nc form d 410. Apply a check mark to indicate the choice. Enter your official contact and identification details. The advanced tools of the editor will lead you through the editable pdf.

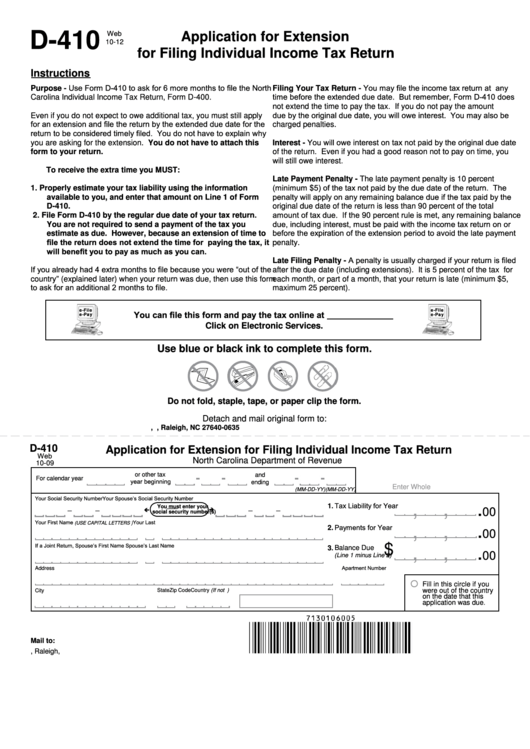

Fillable Form D410 Application For Extension For Filing Individual

However, because an extension of time to ile the return does not extend the time for paying the tax,. Sales and use electronic data interchange (edi) step by step instructions for efile; You are not required to send a payment of the tax you estimate as due. Apply a check mark to indicate the choice. If you were granted an.

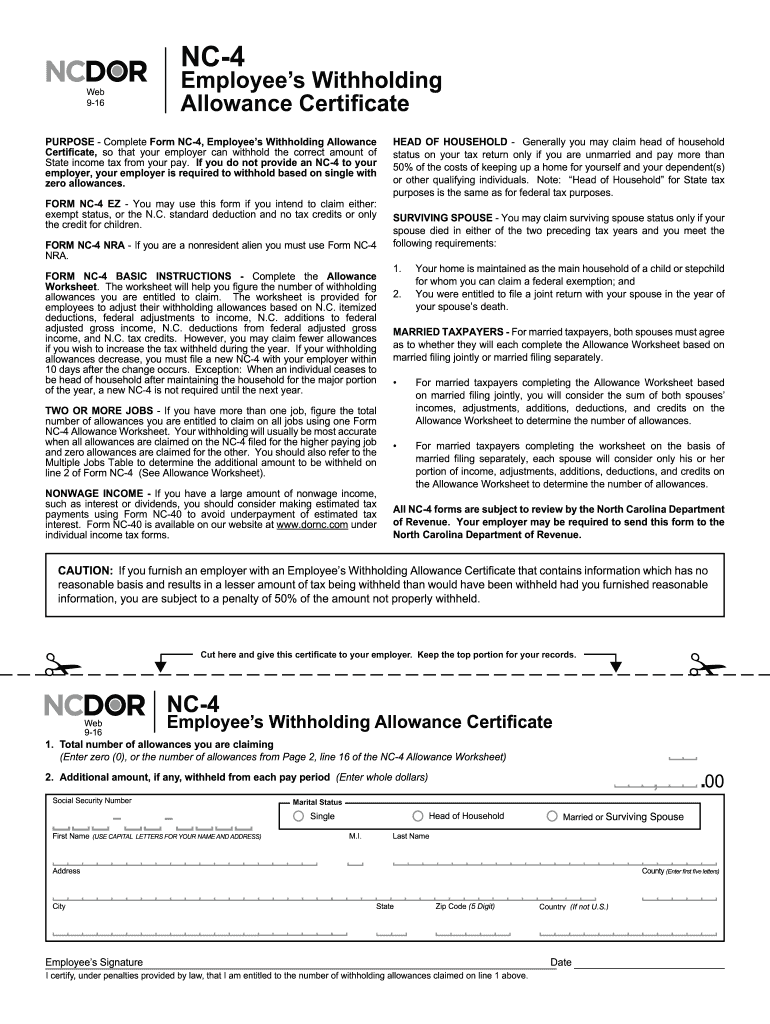

Form NC4 North Carolina Department of Revenue Fill out & sign

The days of distressing complicated tax and legal forms are over. D410 nc tax extension get d410 nc tax extension how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save d410 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

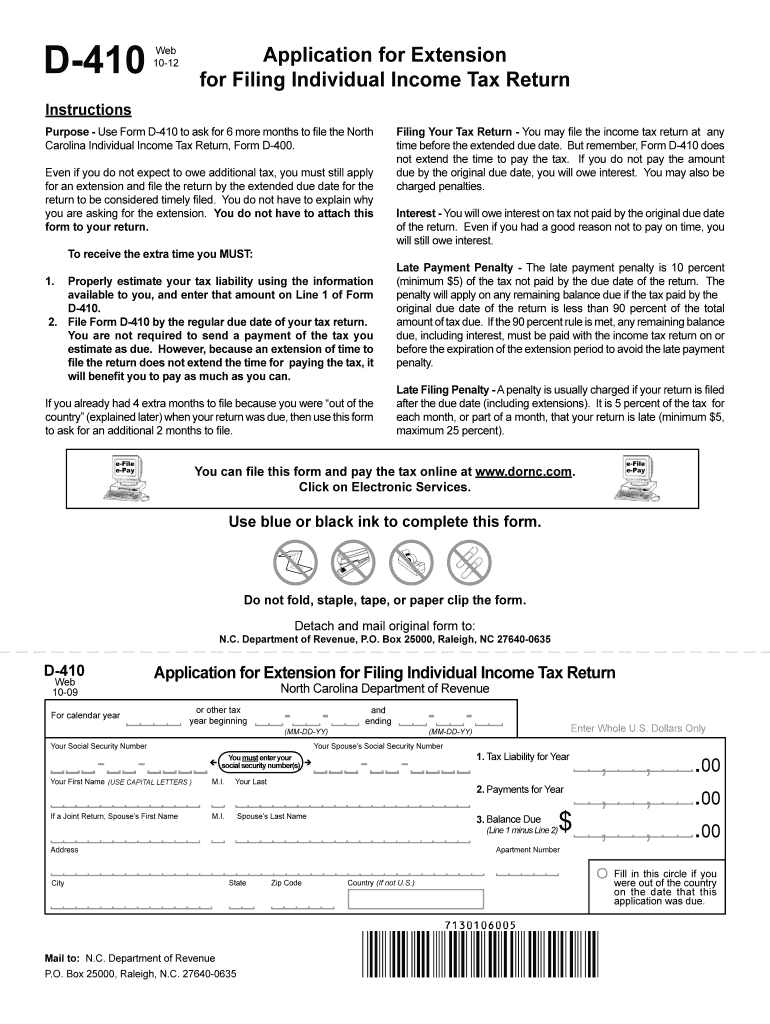

Form D 410 Form Fill Out and Sign Printable PDF Template signNow

However, because an extension of time to ile the return does not extend the time for paying the tax,. To start the document, utilize the fill camp; North carolina department of revenue. Web without a valid state extension, a n.c. Electronic filing options and requirements;

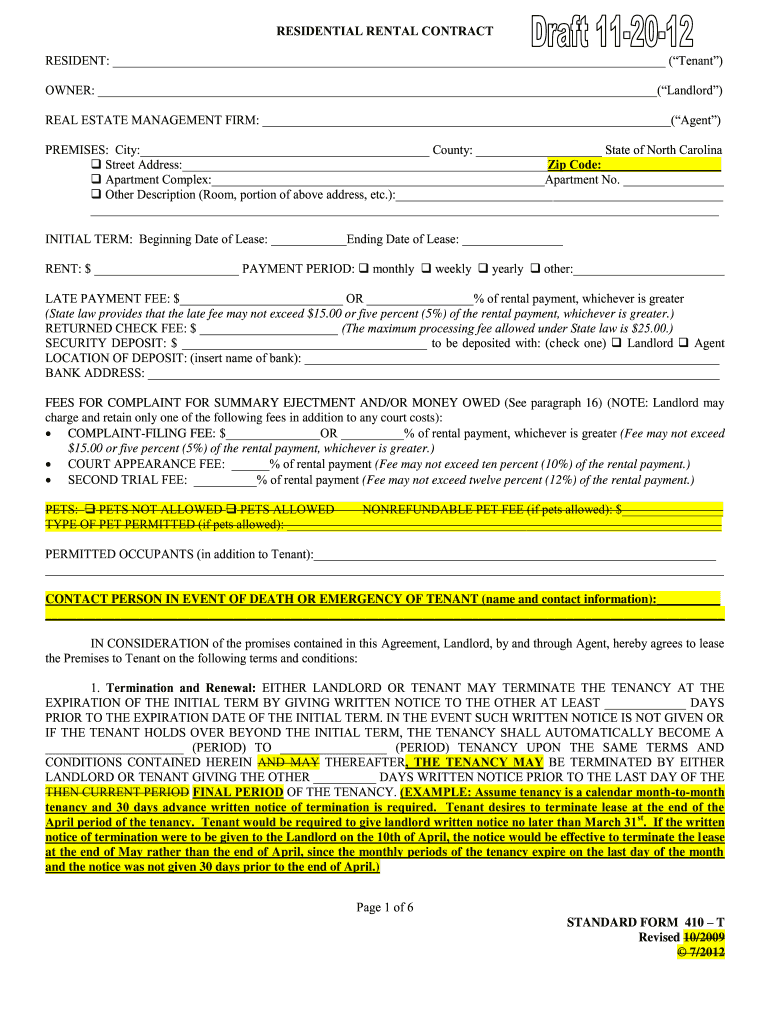

410 In Standard Form Fill Out and Sign Printable PDF Template signNow

Pay a bill or notice (notice required). Pay a bill or notice (notice required). Sales and use electronic data interchange (edi) step by step instructions for efile; However, because an extension of time to ile the return does not extend the time for paying the tax,. You are not required to send a payment of the tax you estimate as.

Apply a check mark to indicate the choice. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. To start the document, utilize the fill camp; Electronic filing options and requirements; Individual income tax refund inquiries: The days of distressing complicated tax and legal forms are over. You are not required to send a payment of the tax you estimate as due. A powerhouse editor is already close at hand giving you a wide range of advantageous tools for filling out a printable nc form d 410. Web the way to fill out the nc dept of revenue forms d410 online: You are not required to send a payment of the tax you estimate as due. Web without a valid state extension, a n.c. North carolina department of revenue. Using efile allows you to file federal and state forms at the same time or separately. D410 nc tax extension get d410 nc tax extension how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save d410 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 24 votes This form is not required if you were granted an automatic extension to. The advanced tools of the editor will lead you through the editable pdf template. Web follow the simple instructions below: Sign online button or tick the preview image of the form. Pay a bill or notice (notice required). Pay a bill or notice (notice required).

You Are Not Required To Send A Payment Of The Tax You Estimate As Due.

Web form to your return. Individual income tax return filed after the original due date is delinquent and is subject to interest and all applicable penalties provided by law. Sales and use electronic data interchange (edi) step by step instructions for efile; D410 nc tax extension get d410 nc tax extension how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save d410 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 24 votes

If You Previously Made An Electronic Payment But Did Not Receive A Confirmation Page Do Not Submit Another Payment.

Individual income tax refund inquiries: Apply a check mark to indicate the choice. The days of distressing complicated tax and legal forms are over. Web without a valid state extension, a n.c.

Electronic Filing Options And Requirements;

To receive the extra time you must: Web follow the simple instructions below: North carolina department of revenue. You are not required to send a payment of the tax you estimate as due.

Complete This Web Form For Assistance.

To start the document, utilize the fill camp; Using efile allows you to file federal and state forms at the same time or separately. Enter your official contact and identification details. Pay a bill or notice (notice required).