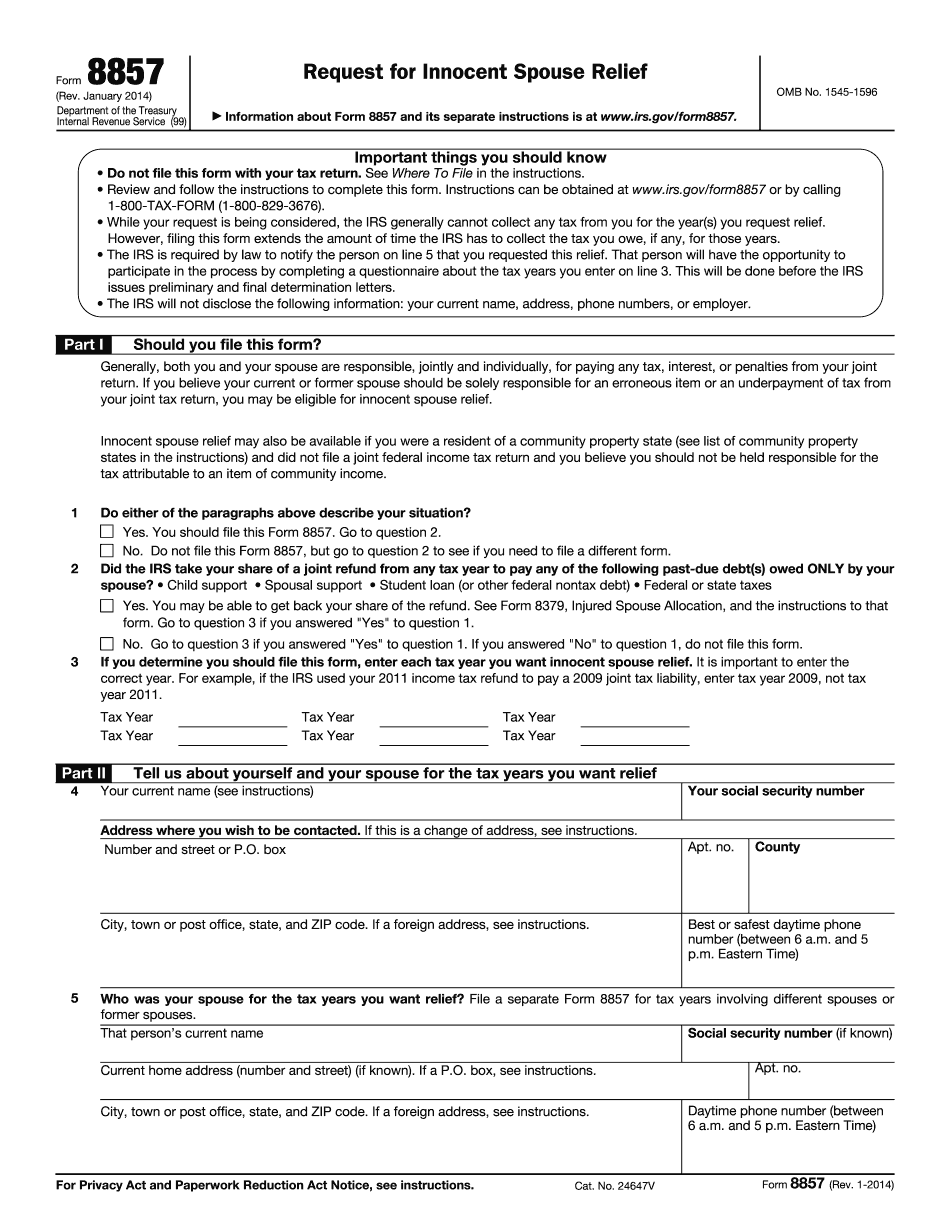

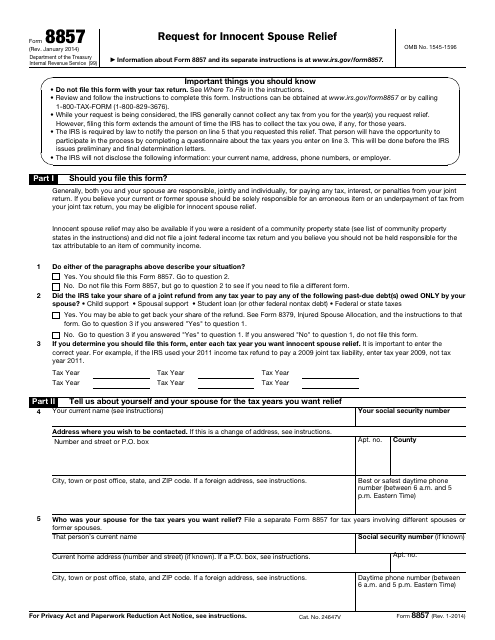

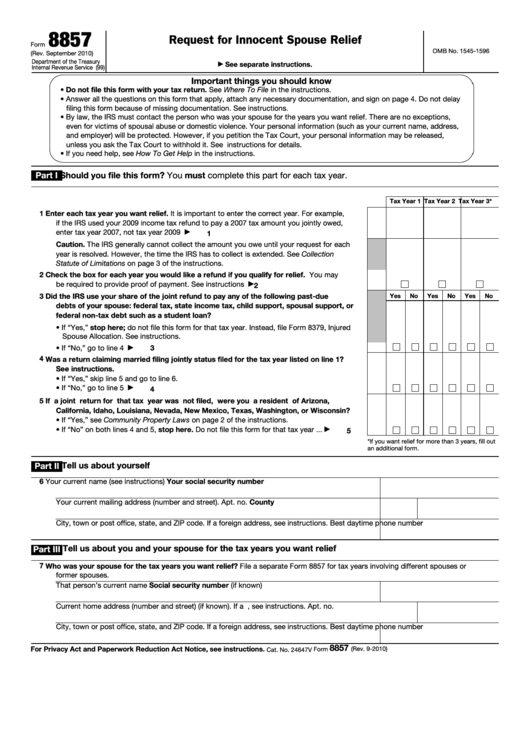

Irs Form 8857 Printable - You should file this form 8857. Share your form with others send 8857 instructions via email, link, or fax. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. Do not file this form with your tax return. Web federal request for innocent spouse relief form 8857 pdf form content report error it appears you don't have a pdf plugin for this browser. In these instructions, the term “your spouse or former spouse” means. 2 did the irs take your share of a joint refund from any tax year to pay any of the following past. Web to file irs form 8857: The irs is required by law to notify the person listed on. Video walkthrough frequently asked questions where can i find irs form 8857?

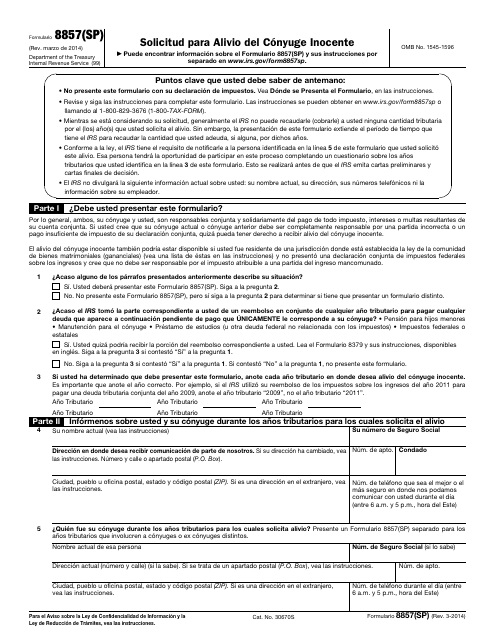

IRS Formulario 8857(SP) Download Fillable PDF or Fill Online Solicitud

Log in to the editor with your credentials or click on create free account to test the tool’s features. January 2014) request for innocent spouse relief department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Download the complete innocent spouse relief form from irs website. The irs is required by law.

Your Guide To Filing Form 8857 Request For Innocent Spouse Relief

Do not file this form with your tax return. Do not file form 8857 for any tax year to which the following period. Include the information that supports your position, Web to file irs form 8857: Web form 8857 should be filed with your return on efile.com as soon as possible to eliminate any inaccurate dues in the form of.

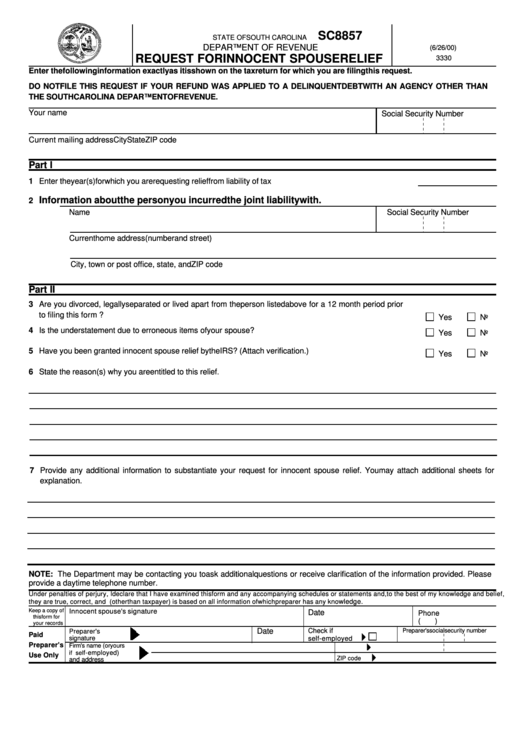

Form Sc8857 Request For Innocent Spouse Relief printable pdf download

Web signature block what is irs form 8857? What should i know before i file irs form 8857? Web federal request for innocent spouse relief form 8857 pdf form content report error it appears you don't have a pdf plugin for this browser. Fill out all the specific information required, including current name, address, daytime phone number(s), information about your.

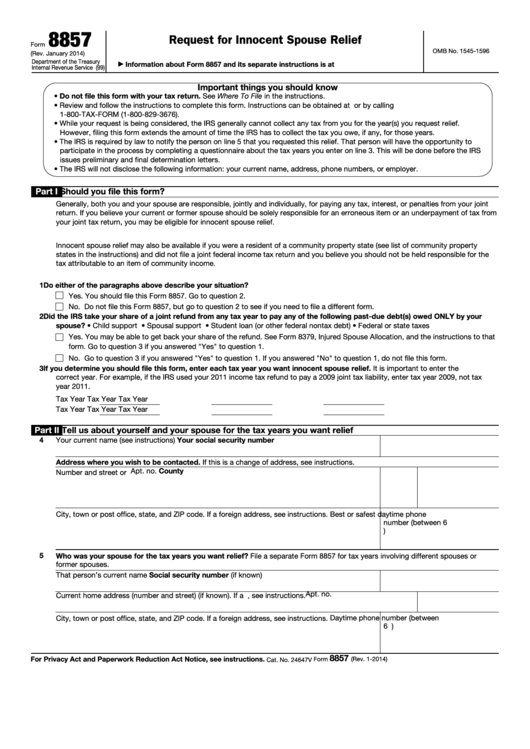

Fillable Form 8857 Request For Innocent Spouse Relief printable pdf

Register and log in to your account. Inthese instructions, the term “your spouse or former spouse” means the person who was your spouse for the year(s) you want relief. You should file this form 8857. Innocent spouse relief separation of liability relief equitable relief when should i file irs form 8857? Do not file this form with your tax return.

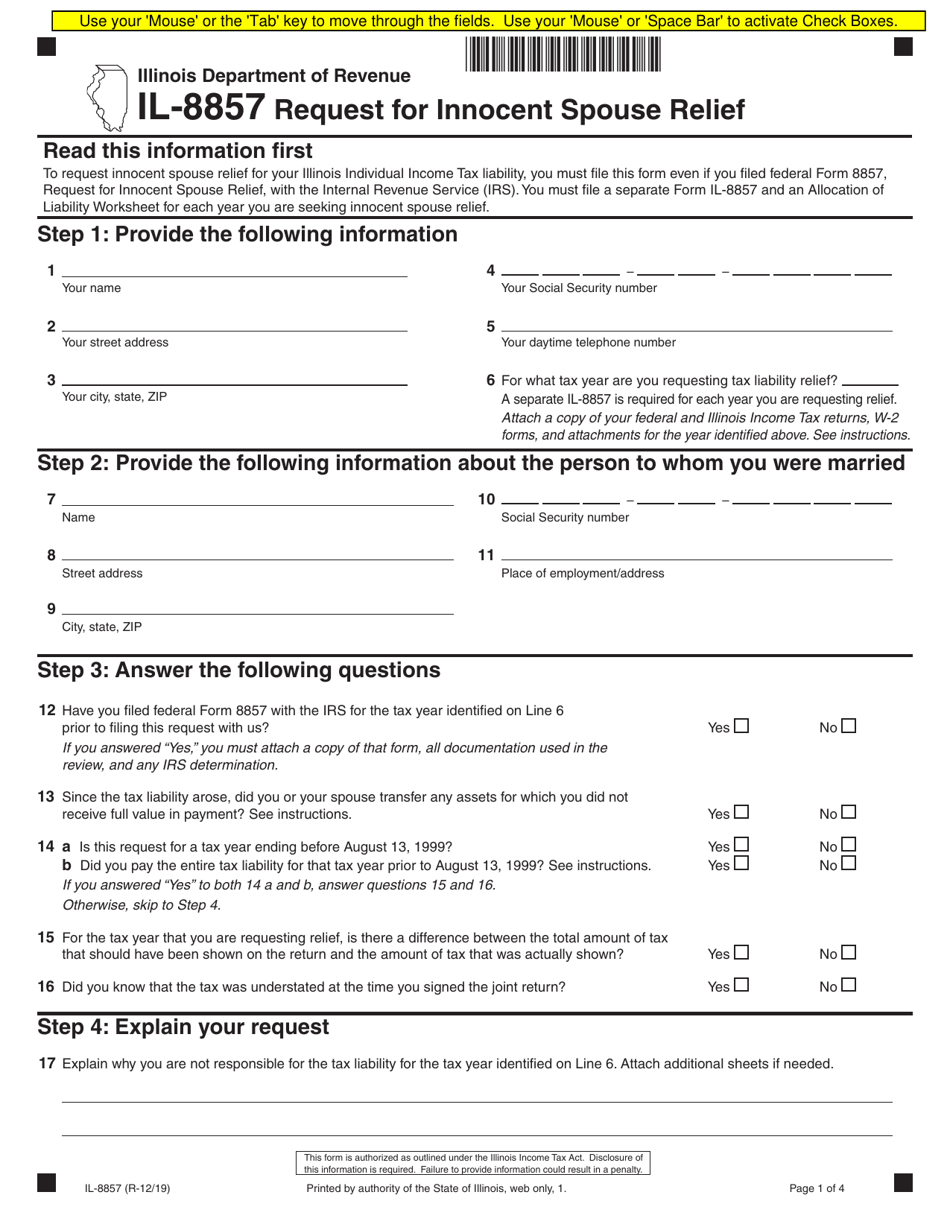

Form IL8857 Download Fillable PDF or Fill Online Request for Innocent

Add the irs form 8857 for editing. Web the form 8857 instructions and pub. Fill out all the specific information required, including current name, address, daytime phone number(s), information about your employer, your assets, and amount of income. Web instructions for form 8857 (rev. It's to find a default application that can help make edits to a pdf document.

The Fastest Way To Edit Document IRS Form 8857

January 2014) department of the treasury internal revenue service (99) request for innocent spouse relief. You should file this form 8857. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. Web instructions for form 8857 (rev. Information about form 8857 and its separate instructions is at.

IRS Form 8857 Download Fillable PDF, Request for Innocent Spouse Relief

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web instructions for form 8857 (rev. January 2014) department of the treasury internal revenue service (99) request for innocent spouse relief. Web to file irs form 8857: How you should submit the irs 8857 where to send.

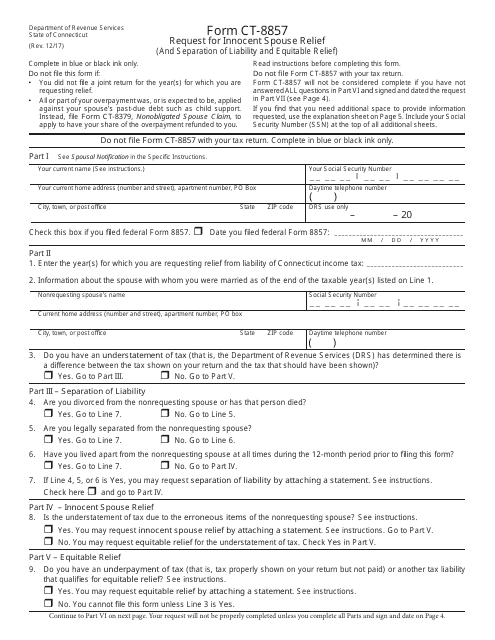

Form CT8857 Download Printable PDF or Fill Online Request for Innocent

June 2021) request for innocent spouse relief section references are to the internal revenue code unless otherwise noted. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. Do not file form 8857 for any tax year to which the following period. Web instructions for form 8857.

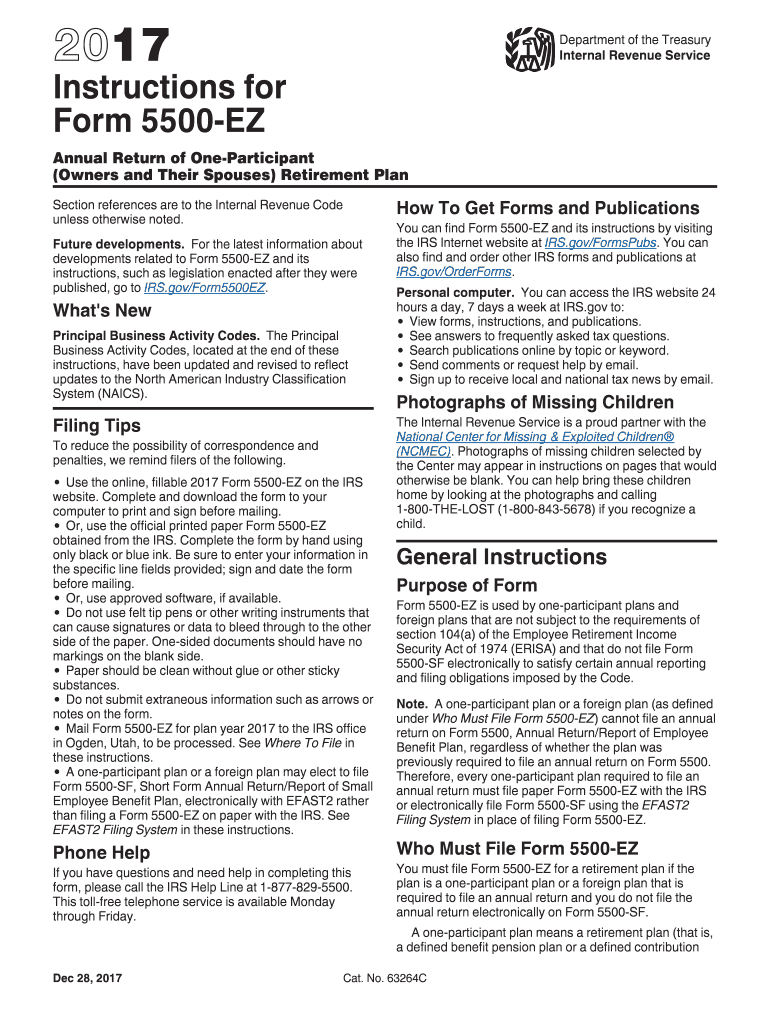

IRS 5500EZ Instructions 2017 Fill and Sign Printable Template Online

Web form 8857 should be filed with your return on efile.com as soon as possible to eliminate any inaccurate dues in the form of tax liability that should belong to the other spouse. Important things you should know. Someone who prepares form 8857 but does not charge you should not sign it. 2 did the irs take your share of.

Fillable Form 8857 Request For Innocent Spouse Relief printable pdf

The preparer must give you a copy of form 8857 for your records. Fill out all the specific information required, including current name, address, daytime phone number(s), information about your employer, your assets, and amount of income. Web form 8857 is used to request relief from tax liability when a spouse or former spouse should be held responsible for all.

Edit your form 8857 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Web application for irs individual taxpayer identification number. Department of the treasury internal revenue service your name your social security number 1 enter the year(s) for which you are requesting relief from liability of tax (see instructions)' cat. Web form 8857 should be filed with your return on efile.com as soon as possible to eliminate any inaccurate dues in the form of tax liability that should belong to the other spouse. How you should submit the irs 8857 where to send the irs form 8857 a reference guide for filling out the irs 8857 Web download your fillable irs form 8857 in pdf table of contents the legal definition of the case two primary ways of reporting the tax return what is the general purpose of form 8857? Download this form print this form The irs is required by law to notify the person listed on. 971 are available at www.irs.gov attach the complete copy of any document requested or that you otherwise believe will support your request for relief. In these instructions, the term “your spouse or former spouse” means. 9 draft ok to print pager/sgml fileid: Add the irs form 8857 for editing. Video walkthrough frequently asked questions where can i find irs form 8857? Someone who prepares form 8857 but does not charge you should not sign it. The preparer must give you a copy of form 8857 for your records. Download the complete innocent spouse relief form from irs website. Web follow these quick steps to modify the pdf irs form 8857 online for free: January 2014) request for innocent spouse relief department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Log in to the editor with your credentials or click on create free account to test the tool’s features. It's to find a default application that can help make edits to a pdf document.

How You Should Submit The Irs 8857 Where To Send The Irs Form 8857 A Reference Guide For Filling Out The Irs 8857

Add the irs form 8857 for editing. Web form 8857 is used to request relief from tax liability when a spouse or former spouse should be held responsible for all or part of the tax. Take a look at the manual below to form some basic understanding about possible approaches to edit pdf on your windows system. The preparer must give you a copy of form 8857 for your records.

Web Download Your Fillable Irs Form 8857 In Pdf Table Of Contents The Legal Definition Of The Case Two Primary Ways Of Reporting The Tax Return What Is The General Purpose Of Form 8857?

Web instructions for form 8857 (rev. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. 2 did the irs take your share of a joint refund from any tax year to pay any of the following past. January 2014) department of the treasury internal revenue service (99) request for innocent spouse relief.

Sign It In A Few Clicks Draw Your Signature, Type It, Upload Its Image, Or Use Your Mobile Device As A Signature Pad.

In these instructions, the term “your spouse or former spouse” means. Web upload the internal 8857 pdf edit & sign irs innocent spouse form from anywhere save your changes and share form 8857 rate the innocent spouse relief 4.8 satisfied 150 votes what makes the internal 8857 pdf legally valid? Log in to the editor with your credentials or click on create free account to test the tool’s features. Web federal request for innocent spouse relief form 8857 pdf form content report error it appears you don't have a pdf plugin for this browser.

Department Of The Treasury Internal Revenue Service Your Name Your Social Security Number 1 Enter The Year(S) For Which You Are Requesting Relief From Liability Of Tax (See Instructions)' Cat.

Important things you should know. Do not file this form 8857, but go to question 2 to see if you need to file a different form. What should i know before i file irs form 8857? Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number.